Precarious Predictions – how many “ifs” does it take?

On December 4th, The Economist reported the following in an article entitled Omicronomics :

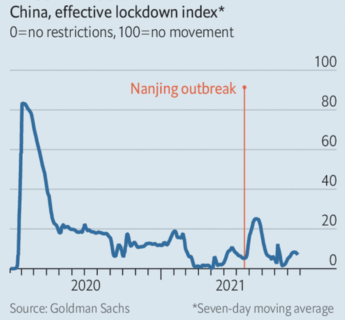

If the Omicron variant is more infectious than other strains, it will increase the likelihood of covid-19 outbreaks in China, leading to more frequent lockdowns. If the restrictions were as severe as those China briefly imposed in mid-August, when it was fighting an outbreak that began in the city of Nanjing, the toll on growth could be considerable. If imposed for an entire quarter, the curbs could subtract almost $130bn from China’s GDP, according to our calculations based on a model of lockdowns by Goldman Sachs, a bank—equivalent to around 3% of quarterly output.

Supported by graphs and the authority of Goldman and Sachs, the conclusion appears trustworthy even if it is based on several strong hypotheses of what the future will bring. Let alone the precarity of the so-called Effective Lockdown Index (ELI), an “objective measure” constructed by Goldman and Sachs since April 2020, combining into a single number “two prominent measures of lockdowns and social distancing” — an adjusted version of the Oxford policy stringency index, which combines in itself seven policy measures (school closings, workplace closings, public event cancellations, closure of public transportation, public information campaigns, internal movement restrictions and international travel controls), and data from the Google global mobility reports. The latter gauges shifts in behaviour of local populations. Yet, as Goldman and Sachs notes, besides four other caveats, “unfortunately, neither source includes mainland China and hence for China we use urban subway traffic data as proxy for mobility.”

On such uncertain basis and additional assumptions about the property sector, GDP growth scenarios for China are developed by analysts which lead to diverging, yet powerful, predictions ranging between as low as 2.1% and 5.5% — figures that confirm and nurture the West’s expectations and anxieties for China’s GDP growth to slow.

(posted by Andrea Bréard)